-

LATEST NEWS / PRODUCT & TECHNOLOGY / SiC / TOP STORIES / WBG3 Min Read

Toshiba Electronic Devices & Storage Corporation and Toshiba Corporation (Toshiba Group) have developed technology that mitigates the parasitic oscillation that occurs during switching operations by power modules with silicon carbide (SiC) MOSFETs connected in parallel, even with a 60% smaller gate resistance than is typical. The technology reduces power loss in power modules, mitigates oscillation, and realizes highly reliable switching operations.

The drive for carbon neutrality is stimulating demand for technologies that improve energy efficiency in many areas, including renewables, railways, and industrial equipment. In these sectors, the application of power modules built around SiC MOSFETs is seen as a solution that supports high-speed switching at high voltages and large currents—which is particularly important for the miniaturization of power converters, where higher switching frequencies result in higher rates of switching losses against power consumption.

Connecting multiple chips in parallel in power modules can form oscillation circuits, the result of wiring inductance between the chips and their parasitic capacitance. It can reduce module reliability if not countered, which is usually done by increasing gate resistance. However, this approach slows switching speed, resulting in a trade-off with switching losses. For power modules with SiC MOSFETs to perform high-speed switching, another approach is needed.

Toshiba Group used an equivalent circuit model of the power module (Figure 1) to determine the theoretical condition that triggers parasitic oscillation, and developed a wiring layout less likely to cause it. This was done by analyzing simulations of parasitic oscillation occurs when Lg/Ls, the ratio of gate-to-gate inductance Lg and source-to-source inductance Ls of parallel chips, is below a certain value (Figure 2). As increasing Lg/Ls is an effective means of mitigating parasitic oscillation, Toshiba Group fabricated prototype modules with different Lg/Ls and measured switching. This confirmed that increasing Lg/Ls mitigated oscillation, even with a 60% smaller gate resistance than that required by the alternative approach of increasing gate resistance (Figure 3).

Applying this approach to oscillation mitigation in power modules now under development has realized a power module less likely to cause parasitic oscillation, even with minimal gate resistance, that achieves low power loss with mitigated oscillation, and delivers highly reliable switching operation. Toshiba Group will continue to make refine the modules toward an early product launch.

Toshiba Group presented the details of this technology on June 6 at the 36th International Symposium on Power Semiconductor Devices and ICs (ISPSD) 2024, an international power semiconductor conference held in Bremen, Germany from June 2 to 6.

Figure 1. Model equivalent circuit of two MOSFETs connected in parallel

Figure 2. Simulation of oscillation in two MOSFETs with zero gate resistance connected in parallel

Vgs: Gate-Source voltage, Vds: Drain-Source voltage, Id: Drain current

Figure 3. Switching waveforms and switching losses of the prototype modules (Source: Toshiba Group tests) Original – Toshiba

-

LATEST NEWS / SiC / TOP STORIES / WBG3 Min Read

onsemi has signed a multi-year deal with Volkswagen Group to be the primary supplier of a complete power box solution as part of its next-generation traction inverter for its Scalable Systems Platform (SSP). The solution features silicon carbide-based technologies in an integrated module that can scale across all power levels – from high power to low power traction inverters to be compatible for all vehicle categories.

“By offering a complete power system solution that encompasses the entire power sub-assembly, we provide Volkswagen Group with a single, simplified modular and scalable platform that maximizes efficiency and performance for their vehicle lineup,” said Hassane El-Khoury, president and CEO of onsemi. “This new approach allows for the customization of power needs and the addition of features for different vehicles without compromising on performance, all while reducing cost.”

Based on the EliteSiC M3e MOSFETs, onsemi’s unique power box solution can handle more power in a smaller package which significantly reduces energy losses. The inclusion of three integrated half-bridge modules mounted on a cooling channel will further improve system efficiency by ensuring heat is effectively managed from the semiconductor to the coolant encasement.

This leads to better performance, improved heat control, and increased efficiency, allowing EVs to drive further on a single charge. By using this integrated solution, Volkswagen Group will be able to easily transition to future EliteSiC-based platforms and remain at the forefront of EV innovation.

“We are very pleased to have onsemi as a strategic supplier for the power box of the traction inverter for our first tranche in the SSP platform. onsemi has convinced us with a deeply verticalized supply chain from the growth of the raw material up to the assembly of the power box,” said Mr. Dirk Große-Loheide, Member of the Extended Executive Committee Group Procurement and Member of the Board Volkswagen Brand for “Procurement”.

Mr. Till von Bothmer, Senior Vice President VW Group Procurement for Powertrain added, “On top of the verticalization, onsemi has furthermore provided a resilient supply concept with regional silicon carbide fabs across Asia, Europe and the U.S. In addition, onsemi will continuously provide the latest SiC generation to ensure competitiveness.

Volkswagen Group will also benefit from onsemi’s planned investment to expand its silicon carbide manufacturing in the Czech Republic. The investment would establish an end-to-end production facility in Europe for the traction inverter power system. The proximity of onsemi’s facility would fortify Volkswagen Group’s supply chain while improving logistics and allowing for faster integration into the manufacturing process.

Original – onsemi

-

LATEST NEWS / SiC / TOP STORIES / WBG3 Min Read

Infineon Technologies AG announced that its CoolSiC™ 2000 V modules have been selected by Daihen Corporation for their innovative unit-type power conditioners for grid storage batteries. In the journey towards reducing carbon emissions, both grid storage batteries and the power conditioners that are linked to them play a vital role in facilitating the wider adoption of renewable energy sources like solar and wind power generation.

There has been an increasing demand for higher voltage storage batteries and power conditioners to enhance the effectiveness of power generation, storage, and transmission. Moreover, with the expansion of storage battery systems on a larger scale, finding suitable locations and minimizing construction costs have emerged as significant challenges.

The unit-type power conditioner for grid storage batteries launched by Daihen in March 2024 is the first product in the industry to achieve connection to storage batteries at a high DC link voltage of 1500 V. The higher voltage enables the product to be used with large-capacity storage battery facilities, which has resulted in a 40% reduction in the footprint of grid storage batteries compared to the conventional product.

The high power density is achieved by using Infineon’s 62 mm CoolSiC MOSFET 2000 V module (FF3MR20KM1H). In addition to the characteristics of SiC that enable high voltage, better thermal dissipation and high power density, Infineon’s SiC products feature M1H trench technology that increases the gate drive voltage range and provides high robustness and reliability against gate voltage spikes. Infineon was the pioneer in the industry to introduce the 2000 V class for a SiC module. This innovation has been instrumental in simplifying the inverter circuit configuration. Furthermore, the optimized 62 mm package has led to a substantial reduction in system size, contributing to enhanced efficiency and performance.

Mr. Akihiro Ohori, General Manager, Development Department, Energy Management System Division, Daihen, said, “In order to increase the voltage of power conditioners, the circuit configuration of conventional 1200 V devices had become complicated. However, by adopting Infineon’s 2000 V SiC modules, we were able to achieve a simplified circuit configuration and control design, thereby reducing development resources and the footprint.”

Masanori Fujimori, Marketing Director of the Industrial & Infrastructure Segment at Infineon Technologies Japan, said, “We are very pleased that our pioneering CoolSiC 2000 V module has contributed to the development of the industry’s highest power density power conditioners for grid storage batteries. We believe that Infineon’s SiC technology will address the need for higher efficiency in energy storage systems and will greatly contribute to the growth of renewable energy.”

Original – Infineon Technologies

-

LATEST NEWS / PRODUCT & TECHNOLOGY / SiC / TOP STORIES / WBG2 Min Read

Power Master Semiconductor has released 2nd generation of the 1200V eSiC MOSFET to meet the requirements of higher efficiency, high power density, robust reliability, and ruggedness in various applications such as DC EV charging stations, solar inverters, energy storage systems (ESS), motor drives and industrial power supplies. 1200V eSiC MOSFETs offer significant system advantages such as higher power density, efficiency and less cooling effort due to its much lower power losses.

Therefore, SiC MOSFETs are gaining popularity especially for renewable energy systems, EV charging systems that required higher power density, efficiency and robustness. DC EV charging station is level-3 charger and its power level is increasing by modular configuration as demand of faster charging time and higher battery capacity of EV. DC EV charging provides a mostly constant current output for wide DC output voltage range (200V to 900V) and load profile.

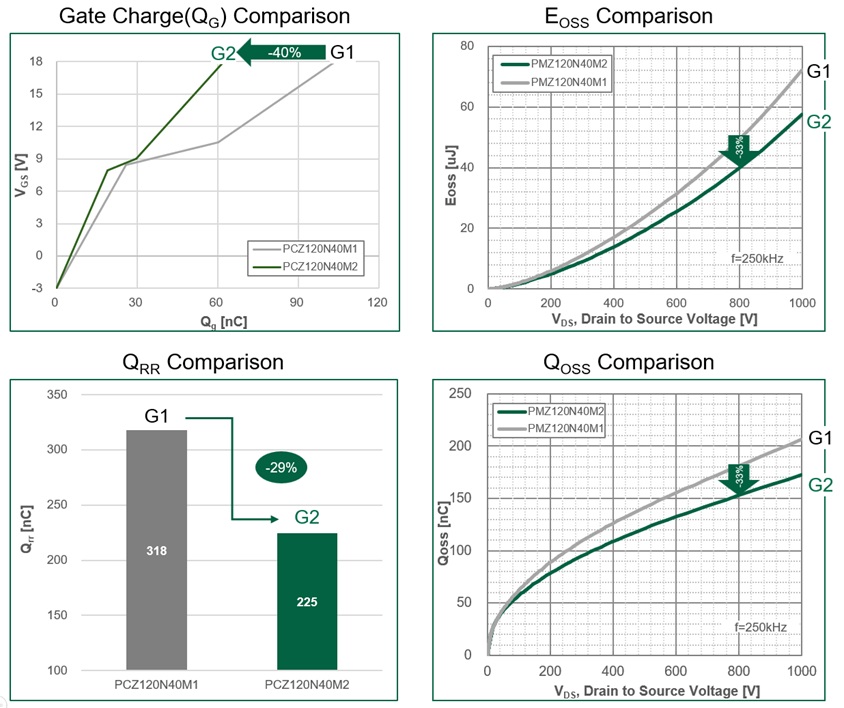

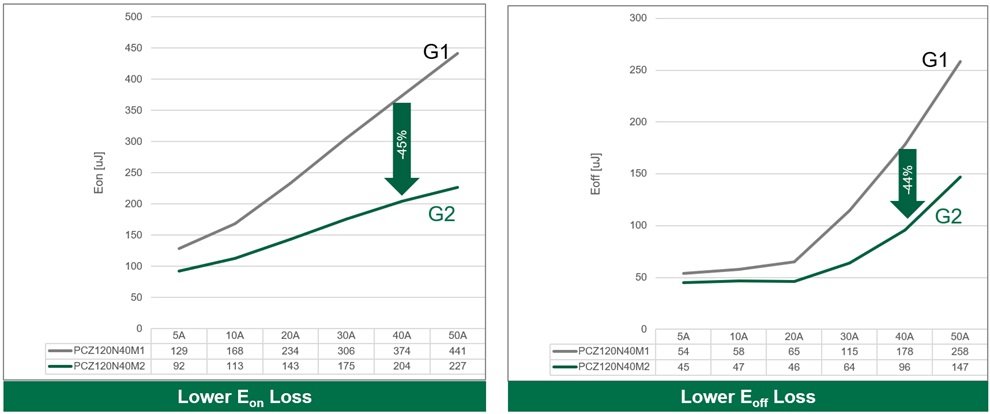

The new generation of 1200V eSiC MOSFET, Gen2 improved key FOM characteristics such as gate charge (QG), stored energy in output capacitance (EOSS), reverse recovery charger (QRR) and output charge (QOSS) by up to 30% compared to previous generation. This new generation SiC MOSFET technology offers significant system advantages such as smaller, lighter, higher efficiency, and less cooling effort thanks to its much lower power losses in various power conversion applications.

1200V eSiC MOSFET Gen2 offer excellent switching performance and 100% tested avalanche capability. It achieved 44% lower switching loss compared to the previous generation by extremely low miller capacitance (QGD).

Power Master Semiconductor is steadfastly committed to developing cutting-edge power device solutions that prioritize efficiency and sustainability,” said Namjin Kim, Sr. Director Sales & Marketing. “The introduction of our new generation of 1200V eSiC MOSFET marks a substantial leap forward in facilitating the development of cleaner, more efficient power systems. We are confident that the 1200V eSiC Gen2 MOSFET will play a transformative role in high-performance applications.

Original – Power Master Semiconductor

-

LATEST NEWS / PRODUCT & TECHNOLOGY / SiC / TOP STORIES / WBG4 Min Read

In the face of escalating climate crises and a dramatic rise in global energy demands, governments and industries are committing to ambitious climate goals aimed at mitigating environmental impact and securing a sustainable future. Key to these efforts is the transition to electrification to reduce carbon emissions and embrace renewable energy resources.

In a significant step towards accelerating this global transition, onsemi introduced its latest generation silicon carbide technology platform, EliteSiC M3e MOSFETs. The company also disclosed plans to release multiple additional generations through 2030.

“The future of electrification is dependent on advanced power semiconductors. Today’s infrastructure cannot keep up with the world’s demands for more intelligence and electrified mobility without significant innovations in power. This is critical to the ability to achieve global electrification and stop climate change,” said Simon Keeton, group president, Power Solutions Group, onsemi. “We are setting the pace for innovation, with plans to significantly increase power density in our silicon carbide technology roadmap through 2030 to be able to meet the growing demands for energy and enable the global transition to electrification.”

The EliteSiC M3e MOSFETs will play a fundamental role in enabling the performance and reliability of next-generation electrical systems at lower cost per kW, thus influencing the adoption and effectiveness of electrification initiatives. With the ability to operate at higher switching frequencies and voltages while minimizing power conversion losses, this platform is essential for a wide range of automotive and industrial applications such as electric vehicle powertrains, DC fast chargers, solar inverters and energy storage solutions.

Additionally, the EliteSiC M3e MOSFETs will enable the transition to more efficient, higher-power data centers to meet the exponentially increasing energy demands that power a sustainable artificial intelligence engine.

Through onsemi’s unique design engineering and manufacturing capabilities, the EliteSiC M3e MOSFETs achieve a significant reduction in both conduction and switching losses on the trusted and field-proven planar architecture. Compared to previous generations, the platform can reduce conduction losses by 30% and turn-off losses by up to 50%.

By extending the life of SiC planar MOSFETs and delivering industry-leading performance with EliteSiC M3e technology, onsemi can ensure the robustness and stability of the platform, making it a preferred choice for critical electrification applications

The EliteSiC M3e MOSFETs also offer the industry’s lowest specific on-resistance (RSP) with short circuit capability which is critical for the traction inverter market that dominates SiC volume. Packaged in onsemi’s state-of-the-art discrete and power modules, the 1200V M3e die delivers substantially more phase current than previous EliteSiC technology, resulting in approximately 20% more output power in the same traction inverter housing. Conversely, a fixed power level can now be designed with 20% less SiC content, saving costs while enabling the design of smaller, lighter and more reliable systems.

Additionally, onsemi provides a broader portfolio of intelligent power technologies including gate drivers, DC-DC converters, e-Fuses and more to pair with the EliteSiC M3e platform. The end-end onsemi combination of optimized, co-engineered power switches, drivers and controllers enable advanced features via integration, lowering overall system cost.

Global energy demands are projected to soar over the next decade, making the need for increased power density in semiconductors paramount. onsemi is leading innovation across its silicon carbide roadmap – from die architectures to novel packaging techniques – that will continue to address the general industry demand for increased power density.

With each new generation of silicon carbide, cell structures will be optimized to efficiently push more current through a smaller area, increasing power density. When coupled with the company’s advanced packaging techniques, onsemi will be able to maximize performance and reduce package size.

By applying the concepts of Moore’s Law to the development of silicon carbide, onsemi can develop multiple generations in parallel and accelerate its roadmap to bring several new EliteSiC products to market at an accelerated pace through 2030.

“We are applying our decades of experience in power semiconductors to push the boundaries of speed and innovation in our engineering and manufacturing capabilities to meet the rising global energy demands,” said Dr. Mrinal Das, senior director of technical marketing, Power Solutions Group, onsemi. “There is a huge technical interdependency between the materials, device and package in silicon carbide. Having full ownership over these key aspects allows us to have control over the design and manufacturing process and bring new generations to market much faster.”

The EliteSiC M3e MOSFET in the industry-standard TO-247-4L package is now sampling.

Original – onsemi

-

LATEST NEWS / TOP STORIES5 Min Read

GlobalWafers Co., Ltd. announced that GWC subsidiaries, GlobalWafers America (GWA) and MEMC LLC, have signed a non-binding preliminary memorandum of terms (PMT) with the U.S. Department of Commerce for up to $400 million in direct funding under the CHIPS and Science Act to support GWC’s construction of advanced silicon wafer manufacturing facilities in Sherman, Texas and St. Peters, Missouri.

When complete, the Sherman, Texas complex will be the first fully integrated advanced silicon wafer production line built in the United States in over 20 years. GWA President Mark England remarked, “With the support of the Biden Administration, we are honored to be bringing to American shores the world’s most cutting-edge 300mm semiconductor wafer technology, filling what the White House has called a “key vulnerability” within the U.S. semiconductor supply chain. GlobalWafers is fully committed to the U.S. market, and we are excited to be playing a defining role in the nation’s semiconductor rebirth.”

With this proposed investment, GWA will also become a key node in Texas’s rapidly developing Silicon Prairie ecosystem. England added, “The state of Texas and the North Texas Texoma region have welcomed GWA with open arms and investment incentives. We are proud to reciprocate their hospitality by bringing to Sherman 1200 construction jobs and 750 high paying manufacturing jobs ranging from production operators to technicians and engineers between now and 2026.” As the only confirmed advanced node wafer manufacturer now investing in the United States, GWA will reduce the United States’ complete dependence on overseas manufacturing facilities to provide wafers for advanced chips.

Already home to semiconductor pioneer Texas Instruments (TI), the GlobalWafers investment will help make North Texas the most unique semiconductor ecosystem in the country as headquarters to the nation’s leading analogue and embedded semiconductor company AND home to the country’s only 300-mm silicon wafer manufacturer for advanced chips. TI Vice President of Worldwide Procurement and Logistics Rob Simpson congratulated both GlobalWafers and the U.S. Department of Commerce on this announcement, noting: “TI welcomes the investment in GlobalWafers America in North Texas, as it will be a very meaningful addition to the growing semiconductor ecosystem here.”

“Texas continues to lead the country as the Best State for Business,” said Governor Greg Abbott. “Companies like GlobalWafers America – the only advanced node wafer manufacturer in the U.S. – are investing in Texas because of our world-class business climate, business-friendly regulations, and young, growing, and highly skilled workforce. GlobalWafers is a crucial partner in our efforts to remain the nation’s No. 1 state for semiconductor manufacturing, and I thank them for choosing North Texas for their new facility.”

In support of national economic and resilience objectives, GWC is committed to developing in the United States a broad range of next-generation wafer technology. This includes establishing a Research and Development Center of Excellence in Sherman as well as building the United States’ only 300-mm manufacturing facility for advanced Silicon-On-Insulator (SOI) wafers at GWC’s MEMC LLC subsidiary in St. Peters, Missouri where the project brings an additional 500 construction jobs and 130 high quality manufacturing jobs.

As the only U.S. source of 300-mm SOI wafers, the MEMC investment will add a new level of resilience to the U.S. supply chain. On this point, Ashlie Wallace, Senior Vice President of Global Supply Chain at GlobalFoundries observed, “GlobalFoundries applauds the proposed CHIPS direct funding to GlobalWafers, a longstanding strategic partner of ours which provides an important domestic supply of silicon wafers critical for the essential semiconductors we manufacture.” Wallace added, “Federal investments across the U.S. semiconductor ecosystem are strengthening our industry and the supply chains that are vital to our customers and the economy.”

Noting the significance of this proposed funding to U.S. supply chain resilience efforts, U.S. Secretary of Commerce Gina Raimondo said, “President Biden is restoring our leadership in the entire semiconductor supply chain – from materials to manufacturing, to R&D. With this proposed investment, GlobalWafers will play a crucial role in bolstering America’s semiconductor supply chain by providing a domestic source of silicon wafers that are the backbone of advanced chips. As a result of this proposed investment, the Biden-Harris Administration is helping to secure our supply chains, which will create over 2,000 jobs across Texas and Missouri and ultimately lower costs and improve economic and national security for Americans.”

In addition to the direct grant funding announced today, GWC plans to apply for the U.S. Treasury Department’s Advanced Manufacturing Investment Credit (AMIC) of up to 25% of qualified expenditures at the GWA and MEMC LLC facilities.

From Hsinchu, Taiwan, GlobalWafers Chairwoman and CEO Doris Hsu expressed her personal thanks to the U.S. Congress, the Department of Commerce, and the Department of Treasury for CHIPS Act support: “Thanks to U.S. Government support, GlobalWafers is pleased to be a key node in the U.S. semiconductor supply chain. I’d like to particularly thank Secretary Raimondo for her partnership and vision throughout this journey. From day one, her encouragement gave me confidence that U.S. Government support for our investment would be significant and strategic to U.S. objectives.”

As a key ESG imperative, GlobalWafers companies across the globe practice green manufacturing and constantly seek to improve energy efficiency, water conservation, waste management and air pollution control. When at full ramp, GWC’s new and expansion facilities in Sherman and St. Peters will recycle up to half of the water used in production and have forward plans to utilize 100% renewable energy to manufacture the world’s most advanced silicon wafers. The GlobalWafers family of companies is committed to reducing our environmental footprint to the fullest extent possible.

GlobalWafers Co., Ltd., the world’s third largest supplier of semiconductor wafers, maintains 18 manufacturing and operational sites spanning three continents and nine countries. The company is a global leader in semiconductor technology, providing innovative and advanced technology solutions to leading chip manufacturers to transform lives around the world.

Original – GlobalWafers

-

LATEST NEWS / PROJECTS / SiC / TOP STORIES / WBG

SiCrystal’s SiC Wafers Production Capacity to Triple by 2027 with a New Production Site in Nuremberg

2 Min ReadIn an important step towards strengthening the semiconductor industry and promoting sustainable technologies, SiCrystal GmbH will create new, additional production space in the north-east of Nuremberg, directly opposite the existing site. The new building will offer an additional 6,000 square meters of production space and will be equipped with state-of-the-art technology to further optimize the production of silicon carbide wafers.

The close proximity to the existing plant will ensure close integration of the production processes. SiCrystal’s total production capacity, including the existing building, will be approximately three times higher in 2027 than in 2024.

“The new space will significantly increase the production capacity for SiC substrates and we are proud that we were able to welcome Mayor König to the ground-breaking ceremony,” says Dr. Robert Eckstein, CEO of SiCrystal. This underlines the importance of this project for the city and the region.

“This groundbreaking ceremony marks an important milestone for SiCrystal and underlines our commitment to the metropolitan region. In this way, we can continue to supply innovative products of the highest quality for our customers in the future and make a positive contribution to global sustainability. “, said Dr. Erwin Schmitt, COO of SiCrystal. “With the additional production capacities, we will strengthen our market position and make an important contribution to technological development in the semiconductor industry.”

Nuremberg’s Mayor Marcus König congratulates on this event: “SiCrystal is one of the world’s leading manufacturers of silicon carbide semiconductor substrates – among other things, these products are needed for the energy transition. I am delighted that SiCrystal is committing itself to Nuremberg as a location with this massive investment and is thus not only retaining jobs but also creating new ones. Nuremberg is an attractive location.”

The construction work is scheduled to be completed by the beginning of 2026. And will create new jobs in the region. The new building is being realized in cooperation with the general contractor Systeambau from Hilpoltstein.

SiC wafers from SiCrystal, a subsidiary of the Japanese ROHM Group, are of crucial importance for the production of high-performance semiconductor components. By using SiC, we can achieve higher efficiency, lower energy consumption and improved performance in various applications such as electric vehicles, solar energy, and industrial equipment.

SiCrystal is proud to be a fast-growing employer in the metropolitan region and aims to increase employment by more than 100 by the end of the 2027/28 financial year.

Original – SiCrystal

-

LATEST NEWS / TOP STORIES3 Min Read

Forge Nano, Inc., a leading ALD equipment provider and materials science company, further expanded into the semiconductor market with the unveiling of its new Atomic Layer Deposition (ALD) product offering – TEPHRA™ – Forge Nano’s new single-wafer, ALD cluster platform. By offering single-wafer ALD coating quality at throughputs similar to the speed of batch systems, Forge Nano’s TEPHRA ™ will allow customers to produce best-in-class coatings at commercial scale with unrivaled precursor efficiency and speed.

Powered by Forge Nano’s ALDx technology, which offers ultrathin, uniform, pinhole-free films with an unprecedented 10x throughput for single-wafer processing, TEPHRA is dedicated to the manufacturing of specialty semiconductor applications on 200mm wafers and below. With 100x efficient chemical use, rapid cycle times, increased yield, and low-risk manufacturing, TEPHRA is the only single-wafer cluster tool with commercial throughput speeds serving applications in advanced packaging, power semiconductor, radio frequency devices (RFD), microLEDs, microelectromechanical systems (MEMS), and more.

“TEPHRA is designed to unlock new capabilities to meet the growing demand of novel More-than-Moore market device applications that seek high-throughput ALD capabilities without sacrificing film qualities. Forge Nano will enable advanced device architectures with groundbreaking efficiency in the semiconductor space with our innovative ALD wafer tools that prioritize cost, performance and efficiency,” said Paul Lichty, CEO of Forge Nano. “With TEPHRA, Forge Nano is opening new coating solutions and opportunities for our proprietary coating techniques that address high aspect ratio structures, which have previously been underserved in the semiconductor industry.”

Forge Nano’s ALDx technology enables conformal coatings to scale to aspect ratios greater than 10:1. With a flagship all-ALD Metal Barrier Seed film application, TEPHRA offers nitride and metal depositions in high aspect ratio structures for advanced 3D integration applications, including through silicon and through glass vias. By moving beyond 10:1 aspect ratios, manufacturers can scale their packaging processes and reduce power consumption by overcoming common pitfalls of directional deposition technologies, including PEALD, which struggle with conformality and void formation.

TEPHRA is available in a range of configurations with the option for four-sided, six-sided and eight-sided cluster platforms. TEPHRA can process wafers up to 200 mm between 80 and 300°C with six process precursor channels and dedicated chambers for oxide, nitride and metal depositions. TEPHRA ™ also features Forge Nano’s patented CRISP technology, a suite of catalyzed thermal ALD processes that enable low temperature and hard-to-deposit materials without the need for plasma.

For more information on Forge Nano’s TEPHRA ™ product, visit the TEPHRA product page at: https://www.forgenano.com/products/tephra. SEMICON West 2024 attendees can stop by the Forge Nano booth (#133), located in the south exhibition hall, for additional product information and to discuss capabilities with our product specialists.

Original – Forge Nano

-

GaN / LATEST NEWS / TOP STORIES / WBG3 Min Read

GlobalFoundries announced that it has acquired Tagore Technology’s proprietary and production proven Power Gallium Nitride (GaN) IP portfolio, a high-power density solution designed to push the boundaries of efficiency and performance in a wide range of power applications in automotive, internet of things (IoT) and artificial intelligence (AI) datacenter. As the digital world continues to evolve with technologies like Generative AI, GaN stands out as a pivotal solution for sustainable and efficient power management particularly in datacenters.

Today’s announcement reinforces GF’s commitment to large-scale manufacturing of GaN technology that offers a suite of benefits to help datacenters meet the increasing power demands while maintaining or improving power efficiency, reducing costs and managing heat generation. The acquisition expands GF’s power IP portfolio and broadens access to market leading GaN IP that will enable GF customers to quickly bring differentiated products to market. As a part of the acquisition, a team of experienced engineers from Tagore, dedicated to the development of GaN technology, will be joining GF.

“We are committed to being the foundation of our customers’ power applications today and for decades to come,” said Niels Anderskouv, chief business officer at GF. “With this acquisition, GF takes another step toward accelerating the availability of GaN and empowering our customers to build the next generation of power management solutions that will reshape the future of mobility, connectivity and intelligence.”

“The accelerating demand for more power efficient semiconductors is dramatically increasing, and Tagore has been at the forefront of developing disruptive solutions using GaN technology for a wide range of power devices,” said Amitava Das, co-founder and chief operating officer of Tagore Technology. “The team and I are excited to join GlobalFoundries to increase our focus on market-leading IP that will help address power design challenges and support the continued evolution of automotive, industrial and AI datacenter power delivery systems.”

In February 2024, GF was awarded $1.5 billion in direct funding under the U.S. CHIPS and Science Act, part of that investment is targeted towards enabling the high-volume manufacturing of critical technologies including GaN to securely produce more essential chips.

Combining this manufacturing capacity with the technical know-how of the Tagore team, GF is set to transform AI system efficiency, especially in edge or IoT devices, where reduced power consumption is critical.

“GlobalFoundries is at the forefront of technological advancements. With Tagore Technology joining the GF India team, we will further enhance our tech capabilities, particularly in emerging areas like GaN,” said Jitendra Chaddah, vice president and India country head at GF. “I welcome the Tagore team to GF, and I am excited about the work we will do as we continue to grow and strengthen our engineering capabilities together.”

Original – GlobalFoundries

-

LATEST NEWS / PROJECTS / Si / SiC / TOP STORIES / WBG8 Min Read

SMC Diode Solutions, an American-led semiconductor design and manufacturing company, celebrated the opening of its second power discrete fab in Nanjing, China. The new facility realized volume production only 21 months after groundbreaking in September of 2022, and will begin shipments to customers in Q4 2024 for high power and high voltage rectifiers and MOSFET 6-inch and 8-inch wafers.

This new fab marks a milestone in SMC’s growth as they further invest in the China market and the growing renewable energy sector. The new 300,000 square foot facility is set to produce 1.2 million silicon wafers and 60,000 silicon carbide wafers per year, increasing SMC’s total production by over four times. SMC’s current fab in Lukou, Nanjing currently produces 300,000 silicon wafers per year. The $3 billion RMB investment in the new fab will allow SMC to handle the end-to-end production of silicon carbide products for the first time and has created three hundred new jobs.

“As the world moves towards using more and more renewable energy, we are thrilled to now be able to participate in the sector and be part of the solution to increase green energy usage and protect our Earth. We are very excited to have our new fab up and running and we look forward to servicing our customers’ needs better with the increased capacity.” – Dr. Yunji Corcoran, SMC chairwoman and chief executive officer.

As Nanjing is also home to SMC’s current fab, the city was an advantageous choice for the new fab location. With their experienced management team, starting up the new fab was a seamless process, allowing production to begin not long after breaking ground. The city is also home to abundant resources and engineering talent, making it an ideal place for SMC to grow and expand.

Power Semiconductors Weekly team had pleasure to interview Dr. Yunji Corcoran on this occasion:

- The company history dates back to 1997. Can you tell us about some of the major milestones and your semiconductor journey so far?

Certainly. In the early stages of our company, from 1997 until about 2014, we focused on the US and South Korean markets. We were growing steadily, but remained focused on the quality of our products. From 2014 to 2019, we began to focus on active growth, but I consider this more of a preparation stage for our company’s expansion. We investigated ways to create better products and put more of our R&D efforts into new silicon and Silicon Carbide (SiC) products. We also began strengthening our salesforce globally. From 2019 on, we started shipping our new products, both silicon and SiC. Now, we have reached our most significant milestone to date: opening our second fab and quadrupling our production capabilities. We are beginning a new phase that will focus on growing our presence in the power semiconductor market.

- Today we see many semiconductor companies investing a lot of energy into the automotive, renewables, and AI applications. With a wide product line and a new wafer fab to support further expansion, what are your major areas of interest and how do you see them evolve in the coming years?

Automotive, renewables, and AI are extremely relevant markets for both our company and the overall semiconductor industry right now. AI requires a lot of power supply, so we plan to grow our power supply products in that area alongside our existing customers. Automotive and renewables are newer segments for us and the semiconductor market, but ones with incredibly high demand right now. The market is growing rapidly, so we are growing with aims to successfully compete in those areas as well.

Our plan is to focus on our growth within the power supply market and naturally expand into the sustainable energy market. As the world continues to prioritize clean energy, the demand for EV and renewable energy products will also grow. Since SiC products in particular meet the specific power needs of those applications, a rise in the use of SiC products seems likely. I suspect the semiconductor industry will play a crucial role in providing more clean energy globally, which we are excited to be a part of.

- With the new fab you plan to address both silicon and silicon carbide markets? What is your view on the growing demand for SiC and how SMC Diode Solutions plan to correspond to it?

Yes, our new fab will produce both silicon and SiC products. Our current fab produces approximately 300,000 silicon wafers per year, but our new fab has the capability to produce a total of 1,260,000 wafers per year – 1,200,000 silicon and 60,000 SiC. We are very much focused on our silicon power products and view our SiC line as a natural extension of that.

The growing demand for SiC products makes perfect sense. SiC is a material with remarkable properties. It is considered a “wide bandgap” material, which means that it requires more energy to excite electrons from the valence band to the conduction band compared to standard silicon semiconductors. As a result, it offers superior performance characteristics including higher reverse voltage capabilities and greater stability at high temperatures.

Overall, SiC-based products offer improved efficiency and reliability compared to traditional silicon counterparts. For a lot of newer applications, particularly in the sustainable energy sector, these capabilities have become more and more necessary. We see our new fab opening as a natural response to this demand, ande are increasing our capabilities to grow alongside the market.

- Today you have four major locations in China, South Korea, Germany and the USA. Do you plan to expand your network further?

Yes, definitely. We consider SMC to be a global company, and have a range of operations throughout the world, including our headquarters in China and other offices in the US, Germany, South Korea, the UK, and India. As we grow and gain customers throughout the world, we will continue to establish more locations, whether they are R&D, manufacturing, packaging, or sales offices.

- Speaking of the network and future growth opportunities. Both of your fabs are located in Nanjing. With many companies in the US already taking advantage of the CHIPS and Science Act, do SMC Diode Solutions have any considerations to join the rest and use this chance to strengthen the US presence?

It is exciting that governments are recognizing the importance of semiconductors through initiatives like the CHIPS and Science Act, and I think this will really bolster the industry as a whole. Right now, we’re focused on our manufacturing efforts in Asia, but are open to the possibility as we continue to grow.

- With the rise of the Chinese semiconductor industry and a very competitive landscape, how do you position your company and differentiate from the growing number of new entrants?

The key thing is our products. Our products stand out for their high quality and outstanding performance. Our team’s commitment to customer service really sets us apart as well.

Our company also approaches the semiconductor market from a unique perspective. As a business with global locations and leadership, we deeply understand the needs of the international market. We prioritize high quality standards that the international market demands while benefiting from relatively low overall production costs, creating an ideal product for our customers.

- We see many companies in China, Europe, the US, shifting to the vertical structure and full integration of all processes – from growing the semiconductor boules to the packaging of the final product. What are your thoughts on such an approach and do you see it applicable for your company in the future as well?

I’ve also noticed this trend in the industry. While I can see the benefits of this approach for some, I would not anticipate applying it within SMC. I believe in focusing our efforts on what we’re able to do best. We have specialized in design and manufacturing for over 25 years and plan to continue that.

We do have an existing silicon module line, so we are considering expanding into SiC modules in the future. However, for our company we believe it’s best to stay focused on the functions we currently have and prioritize delivering the highest quality product.

- And lastly, after the announcement of a new fab opening, many of your partners would be willing to engage in discussions to find out more. What trade shows or conferences in the second half of 2024 can they meet the company at?

We would love to engage in those discussions as well. You can find us with our own booth at Electronica 2024 this September in Munich, Germany and the Anaheim Electronics & Manufacturing Show (AEMS 2024) in Anaheim, California this October. We will also be attending ISCRM 2024 in Raleigh, North Carolina this fall.

More often than not, you will find someone from our company at any major semiconductor event. Feel free to contact us at sales@smc-diodes.com for any questions or check our website updates to see where you can find us next.

Original – SMC Diode Solutions