-

LATEST NEWS5 Min Read

Wolfspeed, Inc. announced its results for the fourth quarter of fiscal 2024 and the full 2024 fiscal year.

Quarterly Financial Highlights (Continuing operations only. All comparisons are to the fourth quarter of fiscal 2023.)

- Consolidated revenue of approximately $201 million, as compared to approximately $203 million

- Mohawk Valley Fab contributed approximately $41 million in revenue

- Power device design-ins of $2.0 billion

- Quarterly design-wins of $0.5 billion

- GAAP gross margin of 1%, compared to 29%

- Non-GAAP gross margin of 5%, compared to 31%

- GAAP and non-GAAP gross margins for the fourth quarter of fiscal 2024 include the impact of $24 million of underutilization costs. See “Start-up and Underutilization Costs” below for additional information.

Full Fiscal Year Financial Highlights (all comparisons are to fiscal 2023)

- Consolidated revenue of approximately $807 million, as compared to approximately $759 million

- GAAP gross margin of 10% as compared to 32%

- Non-GAAP gross margin of 13% as compared to 35%

- GAAP and non-GAAP gross margins for fiscal 2024 include the impact of approximately $124 million of underutilization costs. See “Start-up and Underutilization Costs” below for additional information.

“We have two priorities we are focused on: optimizing our capital structure for both the near term and long term and driving performance in our state-of-the-art, 200-millimeter fab, and this quarter was a step forward on both of these priorities,” said Wolfspeed CEO, Gregg Lowe.

“We achieved 20% utilization at Mohawk Valley in June and continued to see strong revenue growth from that fab. Our 200mm device fab is currently producing solid results, which are at significantly lower costs than our Durham 150mm fab. This improved profitability gives us the confidence to accelerate the shift of our device fabrication to Mohawk Valley, while we assess the timing of the closure of our 150mm device fab in Durham. At the JP, we have also made great progress, installing and activating initial furnaces in the fourth quarter. We have already processed the first silicon carbide boules from the JP and the quality is in line with the high-quality materials coming out of Building 10.

“At the same time, we are taking proactive steps to slow down the pace of our CapEx by approximately $200 million in fiscal 2025 and identify areas across our entire footprint to reduce operating costs. We also remain in constructive talks with the CHIPS office on a Preliminary Memorandum of Terms for capital grants under the CHIPS Act. In addition to any potential capital grants from the CHIPS program, our long-term CapEx plan is expected to generate more than $1 billion in cash refunds from Section 48D tax credits from the IRS, of which we’ve already accrued approximately $640 million on our balance sheet,” continued Lowe.

Business Outlook:

For its first quarter of fiscal 2025, Wolfspeed targets revenue from continuing operations in a range of $185 million to $215 million. GAAP net loss is targeted at $226 million to $194 million, or $1.79 to $1.54 per diluted share. Non-GAAP net loss from continuing operations is targeted to be in a range of $138 million to $114 million, or $1.09 to $0.90 per diluted share.

Targeted non-GAAP net loss excludes $88 million to $80 million of estimated expenses, net of tax, primarily related to stockbased compensation expense, amortization of discount and debt issuance costs, net of capitalized interest, project, transformation and transaction costs and loss on Wafer Supply Agreement.

The GAAP and non-GAAP targets from continuing operations do not include any estimated change in the fair value of the shares of common stock of MACOM Technology Solutions Holdings, Inc. (MACOM) that we acquired in connection with the sale to MACOM of our RF product line (RF Business Divestiture).

Start-up and Underutilization Costs:

As part of expanding its production footprint to support expected growth, Wolfspeed is incurring significant factory start-up costs relating to facilities the Company is constructing or expanding that have not yet started revenue generating production. These factory start-up costs have been and will be expensed as operating expenses in the statement of operations.

When a new facility begins revenue generating production, the operating costs of that facility that were previously expensed as start-up costs are instead primarily reflected as part of the cost of production within the cost of revenue, net line item in our statement of operations. For example, the Mohawk Valley Fab began revenue generating production at the end of fiscal 2023 and the costs of operating this facility in fiscal 2024 and going forward are primarily reflected in cost of revenue, net.

During the period when production begins, but before the facility is at its expected utilization level, Wolfspeed expects some of the costs to operate the facility will not be absorbed into the cost of inventory. The costs incurred to operate the facility in excess of the costs absorbed into inventory are referred to as underutilization costs and are expensed as incurred to cost of revenue, net. These costs are expected to continue to be substantial as Wolfspeed ramps up the facility to the expected or normal utilization level.

Wolfspeed incurred $20.5 million of factory start-up costs and $24.0 million of underutilization costs in the fourth quarter of fiscal 2024. No underutilization costs were incurred in the fourth quarter of fiscal 2023.

For the first quarter of fiscal 2025, operating expenses are expected to include approximately $25 million of factory start-up costs primarily in connection with materials expansion efforts. Cost of revenue, net, is expected to include approximately $24 million of underutilization costs in connection with the Mohawk Valley Fab.

Original – Wolfspeed

- Consolidated revenue of approximately $201 million, as compared to approximately $203 million

-

LATEST NEWS4 Min Read

Wolfspeed, Inc. provided an update on key milestones and an operational update.

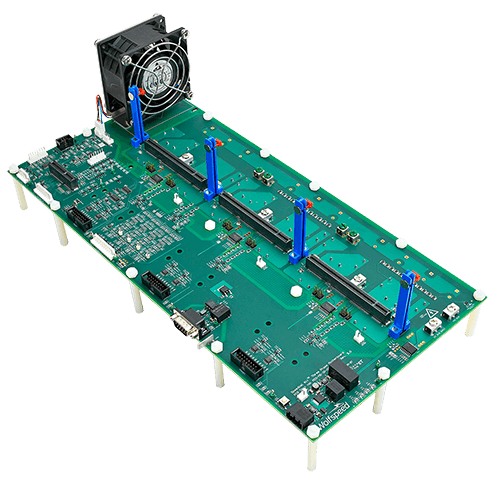

Wolfspeed’s Mohawk Valley silicon carbide fab has reached 20% wafer start utilization, a critical step in the Company’s efforts to meet the growing demand for silicon carbide power devices. Additionally, Wolfspeed’s Building 10 Materials facility has achieved its 200mm wafer production target to support approximately 25% wafer start utilization at the Mohawk Valley fab by the end of calendar year 2024. Wolfspeed plans to update the market on its next utilization milestone for Mohawk Valley during its fiscal Q4 2024 earnings call in August.

The Mohawk Valley fab has also achieved LEED (Leadership in Energy and Environmental Design) Silver certification, a distinction from the world’s most widely used green building framework and rating system. The LEED Silver certification highlights Wolfspeed’s enduring commitment to going beyond compliance, promoting environmental health and industry leading sustainability.

This state-of-the-art Mohawk Valley facility is the world’s first purpose-built, fully automated 200mm silicon carbide fab, and when combined with Wolfspeed’s market-leading 200mm materials production, solidifies Wolfspeed’s competitive position as the only fully vertically integrated 200mm silicon carbide manufacturer at scale.

Additionally, Wolfspeed’s John Palmour Manufacturing Center (“the JP”) in Siler City, NC, which will be the world’s largest, most advanced silicon carbide materials facility upon completion, has installed and recently activated initial furnaces less than one year after vertical construction commenced. As a result, the facility is on schedule to achieve crystal qualification by early August 2024. This meaningful progress reinforces the Company’s confidence that it is well-positioned to ramp the JP in line with its target to deliver wafers from the facility to Mohawk Valley by the summer of 2025.

Wolfspeed also announced that it experienced an equipment incident at its Durham 150mm device fab that resulted in a temporary capacity reduction while the incident was being remediated. Production has been resumed and the Company expects that the Durham 150mm device fab’s capacity utilization can return to previously targeted levels by August. As a result of the production disruption, the Company does not expect an impact on fourth quarter revenue, but does expect to have an underutilization impact and incur other costs in the fourth quarter as described below.

“Having reached our 20% utilization target at Mohawk Valley, we are well-positioned to continue executing our 200mm vertical integration strategy ahead of other market participants,” said Gregg Lowe, president and CEO of Wolfspeed. “Further, recent advancements at the JP put Wolfspeed well on track to achieve our facility targets and significantly expand our materials capacity, driving meaningful progress towards our strategic goals. We quickly identified and resolved an equipment incident at our Durham 150mm device fab, and we continue to focus on execution as we move with urgency to continue this first-of-its-kind ramp.”

Business Outlook

Based on the Durham 150mm device fab equipment incident, Wolfspeed is updating its fiscal fourth quarter 2024 guidance as follows, and providing a preliminary outlook on fiscal first quarter 2025 revenue and non-GAAP gross margin:

- Targeted fiscal fourth quarter revenue from continuing operations is unchanged at $185 million to $215 million; and a potential negative impact to fiscal first quarter 2025 revenue of approximately $20 million.

- Targeted fourth quarter GAAP gross margins in the range of (4%) to 4% and non-GAAP gross margins in the range of 0% to 8%, due to an underutilization impact realized in the fourth quarter and other fourth quarter costs related to the equipment incident. The Company also expects fiscal first quarter 2025 non-GAAP gross margins in a similar range due to underutilization it will realize in the period.

- Fourth quarter GAAP net loss from continuing operations is targeted at $204 million to $182 million, or $1.61 to $1.44 per diluted share. Non-GAAP net loss from continuing operations is targeted to be in a range of $122 million to $105 million, or $0.96 to $0.83 per diluted share. Targeted non-GAAP net loss from continuing operations excludes $77 million to $82 million of estimated expenses, net of tax, primarily related to stock-based compensation expense, amortization of discount and debt issuance costs, net of capitalized interest, project, transformation and transaction costs and loss on Wafer Supply Agreement.

Original – Wolfspeed

-

Wolfspeed, Inc. announced its results for the third quarter of fiscal 2024.

Quarterly Financial Highlights (Continuing operations only. All comparisons are to the third quarter of fiscal 2023):

- Consolidated revenue of approximately $201 million, compared to approximately $193 million

◦ Mohawk Valley Fab contributed approximately $28 million in revenue, over a 2x increase from the prior quarter

◦ Materials revenue of approximately $99 million – second highest quarter on record - Power device design-ins of $2.8 billion

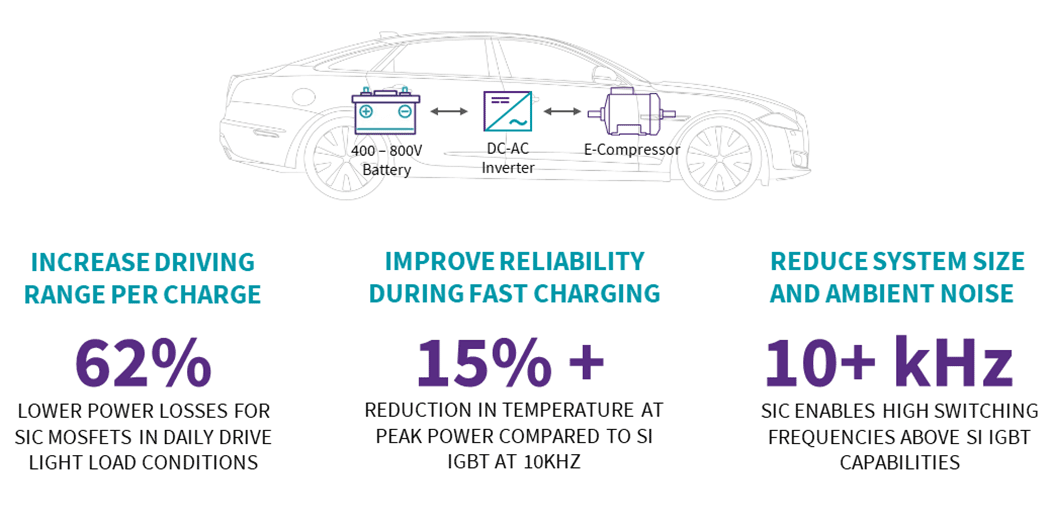

- Quarterly design-wins of $0.9 billion – 70% related to EV applications

- GAAP gross margin of 11%, compared to 31%

- Non-GAAP gross margin of 15%, compared to 34%

◦ GAAP and non-GAAP gross margins for the third quarter of fiscal 2024 include the impact of $30 million of underutilization costs, representing approximately 1,500 basis points of gross margin. See “Start-up and Underutilization Costs” below for additional information.

“We are pleased with the significant operational milestones achieved in the quarter for Wolfspeed as we continue to be the world’s first fully, vertically integrated 200-millimeter silicon carbide player at scale,” said Wolfspeed CEO, Gregg Lowe.

“We are making progress on our Mohawk Valley ramp, more than doubling revenue sequentially in the quarter and reaching more than 16% wafer start utilization in April, giving us confidence in our ability to achieve our 20% utilization target in June 2024. Construction continues at the JP, our 200mm materials factory in North Carolina. During the quarter, we started installing furnaces and connected the facility to the power grid, and we recently hosted our topping out ceremony. As we’ve said before, Mohawk Valley will be the flywheel of growth for Wolfspeed, and the JP will be instrumental in supplying it with high-quality materials. We are encouraged by the operational progress these facilities have made and how it will support our long-term growth trajectory.”

Lowe continued, “While there have been headlines around general demand weakness in EVs, we still have more demand than we can supply for the foreseeable future. Our second highest quarter of design-ins to date and more than $5 billion of designwins so far this fiscal year, tell a compelling story. While the industrial and energy end markets pose short-term headwinds to our results, we firmly believe in the strength of our long-term prospects as the electrification of all things continues across a broad set of applications.”

Original – Wolfspeed

- Consolidated revenue of approximately $201 million, compared to approximately $193 million

-

Wolfspeed, Inc. issued the following statement in response to the letter from JANA Partners (“JANA”) to Wolfspeed’s Board of Directors:

Wolfspeed’s Board of Directors and management team maintain an open dialogue with, and value constructive input from, our shareholders. The company continually evaluates options to enhance long-term value and is committed to acting in the best interests of all our shareholders. The Wolfspeed Board will carefully review JANA’s letter, and we look forward to engaging with them in the near future.

Original – Wolfspeed

-

Wolfspeed, Inc. announced an expanded partnership with FIRST® Robotics Competition to take their shared commitment to science, technology, engineering, and math (STEM) educationinternational. Together, they will sponsor hands-on STEM programs that combine the excitement of athletics with the rigors of science and technology for high school students around the world. This new global sponsorship builds on Wolfspeed’s existing partnership with FIRST to sponsor competitions in the United States.

“At Wolfspeed, inspiring young minds in STEM fields is a core part of our values,” said Wolfspeed Chief Human Resources Officer, Margaret Chadwick. “We are thrilled to expand our partnership with FIRST Robotics Competition on a global scale. The hands-on learning and enthusiastic competition will ignite passion and innovation in students worldwide, while preparing them to become the next generation of inventors and leaders. Together with FIRST, we are committed to making a lasting impact and fostering diversity in our industry through STEM engagement across the globe.”

Wolfspeed’s 2023-2024 season partnership includes a team grant to “Neon Krakens,” the only FIRST Robotics Competition Team in Chatham County, North Carolina. The county is the site of Wolfspeed’s new silicon carbide manufacturing facility, currently under construction and set to be the world’s largest factory of its kind.

“FIRST is dedicated to inspiring young minds in STEM fields and equipping them with the skills needed to succeed in today’s ever-evolving world,” said Collin Fultz, Senior Director, FIRST Robotics Competition. “We are excited to expand our collaboration with Wolfspeed, enhancing the excitement of FIRST Robotics Competition for students worldwide. This partnership will not only help us further ignite a passion for STEM, but also foster diversity in our industry, ultimately helping us create a more innovative and inclusive future.”

Original – Wolfspeed

-

Wolfspeed, Inc. announced its results for the second quarter of fiscal 2024.

Quarterly Financial Highlights (Continuing operations only. All comparisons are to the second quarter of fiscal 2023):

- Consolidated revenue of $208.4 million, compared to $173.8 million

◦ Mohawk Valley Fab contributed $12 million in revenue, a 3x increase from the prior quarter - Power device design-ins of $2.1 billion

- Quarterly record design-wins of $2.9 billion – over 75% related to automotive applications

- GAAP gross margin of 13.3%, compared to 32.6%

- Non-GAAP gross margin of 16.4%, compared to 35.8%

◦ GAAP and non-GAAP gross margins for the second quarter of fiscal 2024 include the impact of $35.6 million of underutilization costs, representing approximately 1,700 basis points of gross margin - Completed sale of our RF Business to MACOM Technology Solutions Holdings, Inc. (MACOM) for $75 million in cash and 711,528 shares of MACOM common stock (the RF Business Divestiture)

“We’re proud of our results this quarter, which reflect robust execution of our strategy and fortify our vision for the future of Wolfspeed and silicon carbide,” said Wolfspeed CEO, Gregg Lowe. “We have made considerable progress at our Mohawk Valley facility, tripling revenue sequentially. Our successful scale-up of 200mm wafer production and continued qualification of high-quality EV products on 200mm substrates are critical steps in meeting the continued customer demand. This is demonstrated by a record $2.9 billion of design-wins, predominantly in the EV sector across multiple OEMs.”

Lowe continued, “Our steadfast commitment to our long-term goals is bolstered by the conversion of our design-ins into significant design-wins. This solidifies our confidence in the electrification trend, which increasingly depends on the widespread adoption of silicon carbide technology. We are pioneers in this transformative era, steering towards a more electrified and efficient future.”

Business Outlook:

For its third quarter of fiscal 2024, Wolfspeed targets revenue from continuing operations in a range of $185 million to $215 million. GAAP net loss from continuing operations is targeted at $134 million to $155 million, or $1.07 to $1.23 per diluted share. Non-GAAP net loss from continuing operations is targeted to be in a range of $71 million to $87 million, or $0.57 to $0.69 per diluted share.

Targeted non GAAP net loss from continuing operations excludes $63 million to $68 million of estimated expenses, net of tax, primarily related to stock-based compensation expense, amortization of discount and debt issuance costs, net of capitalized interest, project, transformation and transaction costs and loss on Wafer Supply Agreement. The GAAP and non-GAAP targets from continuing operations do not include any estimated change in the fair value of the shares of MACOM common stock that we acquired in connection with the RF Business Divestiture.

Original – Wolfspeed

- Consolidated revenue of $208.4 million, compared to $173.8 million